lending club approval process

Even with all the bad press they. The Lending Club website asks you to specify the amount of money you are looking to borrow the purpose.

Lending Club Personal Loans 2022 Review Should You Apply

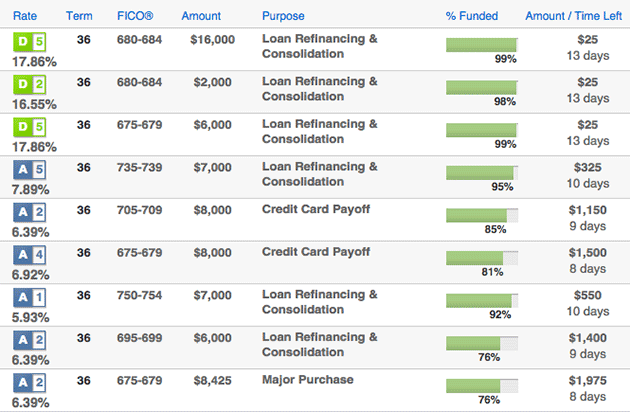

Perhaps the biggest question people have about online lenders is how they determine who will be a good borrower.

. If you are experiencing issues you can. To borrow from LendingClub Bank you must. If Lending Club asks you for documentation or clarification respond immediately.

While they dont see your personal information they can see your credit. Lending Club Approval Process - October 2016 I wanted to share my experience with Lending Club and the approval process this past month. Here is the timeline for my loan application at Lending Club.

LendingClub says the entire application approval and funding process takes 7 business days or fewer on average. You can get approved for a loan from LendingClub within 24 hours and receive funds within two days. By Jonathan Dyer Nov 20 2015 4.

Does LendingClub verify income. You will no longer receive SMS security codes from us until you specifically request a new code via SMS as part of a new login or verification process. Wed 914 Loan is active on the platform for investors.

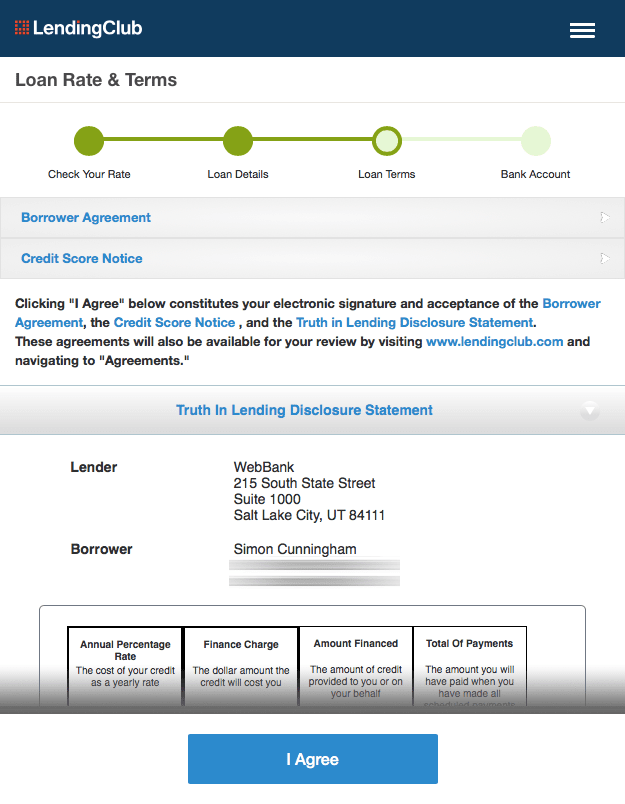

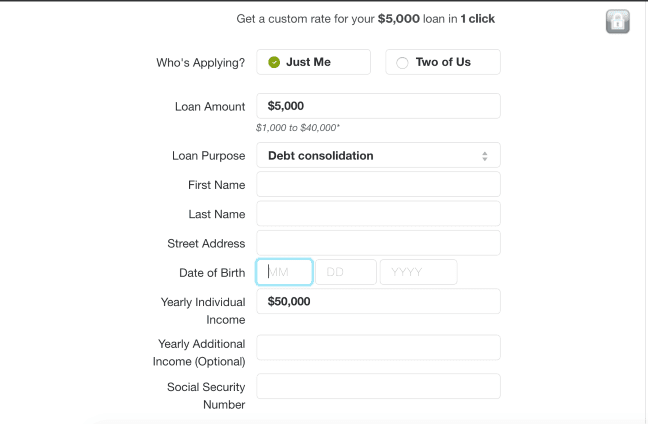

Be a United States citizen or permanent resident or live in the US on a valid long term visa. The loan process begins by using an online tool through LendingClub to check your rate. Confirm your information and review your To-Do List for any outstanding.

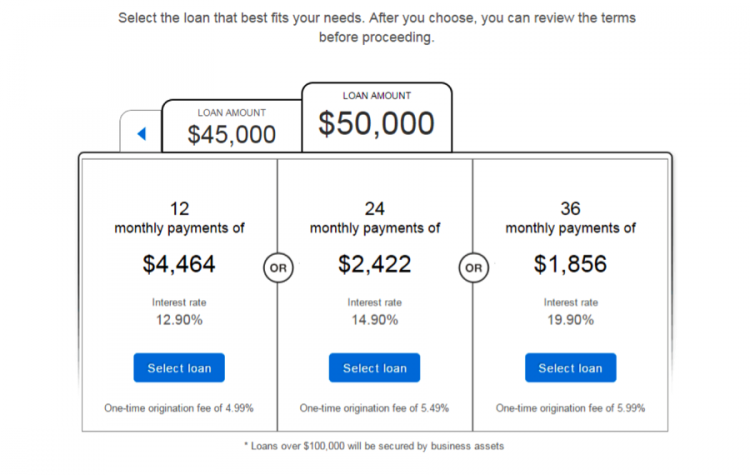

Our process is fast most members are approved for their loans within a couple of hours. Unless otherwise specified all credit and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly owned subsidiary. Youll get multiple loan offers if you qualify so choose the one that works best for you.

We may ask for copies of your recent tax returns or for tax forms such as 1099s or Schedule K1s to verify all of the details. LendingClub verifies the incomes of. Be at least 18 years old.

1 The exact turnaround time youll see for your application will depend on your unique details. If your score is. Once approved LendingClub then lists your loan and grade on its website for investors to review.

Youll find out which loans you qualify for based on your credit score. So if it hasnt yet been 7 business days theres no reason. Four Steps to Borrowing from Lending Club Check Your Rate.

We use this form to request copies of your tax. The applicant will receive an email from LendingClub Patient Solutions prompting them to log in to their Patient Center in order to review and accept their approval documents. It wont expedite the process but you can help friends family and trusted colleagues get the money.

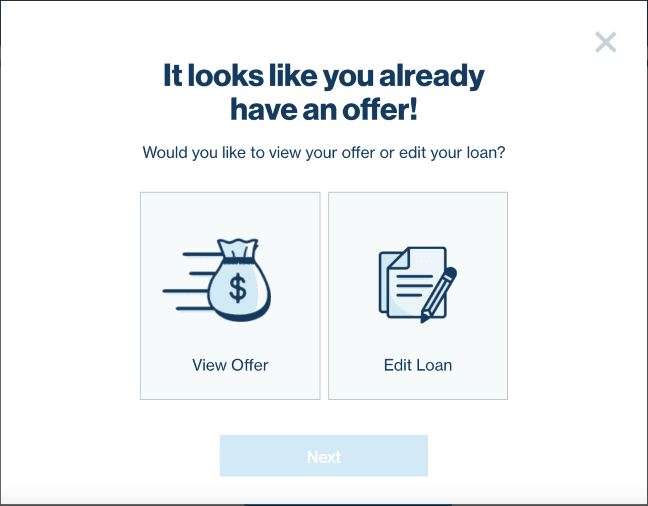

Only once your loan application is approved a hard pull is done on your credit report with the traditional credit bureaus. Finish the online application. Once you select a loan offer you fill out the real application.

Lendingclub Personal Loans 2022 Review Moneyrates

Lending Club Review 2022 Is It A Good Investment For You

Lending Club Review Peer To Peer P2p Lending Explained

Sofi Personal Loans 2022 Review Nerdwallet

Lending Club Review 2022 Peer To Peer Lending Fees Pros Cons

Step By Step Lending Club Business Loan Application In Real Time

How To Apply For A Loan On Lending Club Youtube

Lendingclub Review My Experience Using It Moneyunder30

Lending Club Review For Borrowers 2019 Is This Company Legit

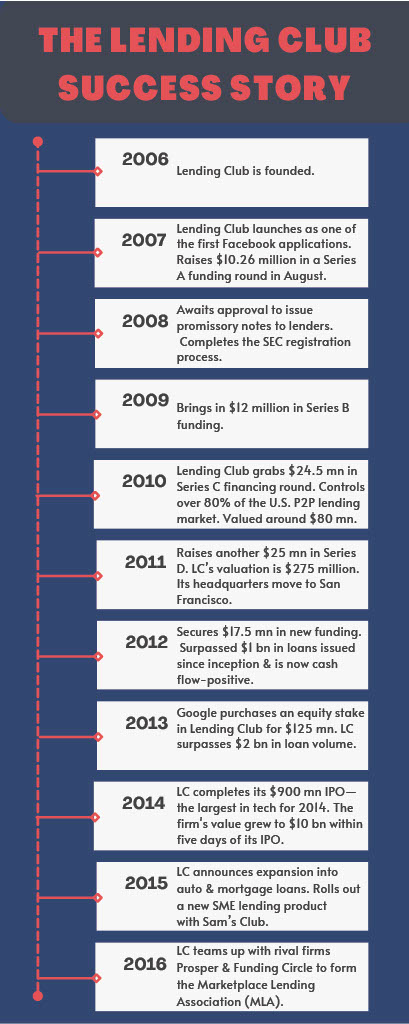

A Brief History Of Lending Club

Managing Your Account Lendingclub

Personal Loan Eligibility Criteria Lenders Look For Lendingclub

Lending Club Loan Application Process What To Expect Lend Academy

Lending Club Review Peer To Peer P2p Lending Explained

What To Expect When Borrowing From Lending Club Part Time Money

Lendingclub Personal Loans Review For 2022 Lendedu

Lendingclub Review My Experience Using It Moneyunder30

Lendingclub Is A Unicorn Value And Growth Wrapped Into One Company Seeking Alpha